In September 2025, Accelleron published a report calling for deeper collaboration across industries to unlock the energy transition. The report, titled “Accelerating to Net Zero - Deadlock: What’s stopping shipping’s carbon-neutral fuel transition?,” argues that shipping alone cannot secure the supply of green hydrogen-based e-fuels it needs to meet the IMO’s ambition of reaching net zero emissions by or around 2050.

The report proposes that governments, ports, shipowners and fuel suppliers work closely to break five crucial deadlocks blocking carbon-neutral fuel development, including: fuel demand fragmentation, geographic availability, financing, regulation, and bunkering infrastructure. Alongside maritime industry efforts, a wider approach to collaboration is also needed.

Shipping on its own cannot afford the green hydrogen production investments it needs to deliver carbon-neutral fuels. Nor can any of six other hard-to-abate industrial sectors: aviation, steel, power generation, agriculture, chemicals, and cement. The solution, Accelleron argues, lies in aggregation of demand across these sectors, to deliver an investable opportunity for fuel producers.

But Accelleron itself is not a shipowner, a port or a government, and its industry reach is focused on delivering technology and services to shipping and power generation companies. So, what is Accelleron’s stake in the carbon-neutral fuel transition?

A legacy of innovation

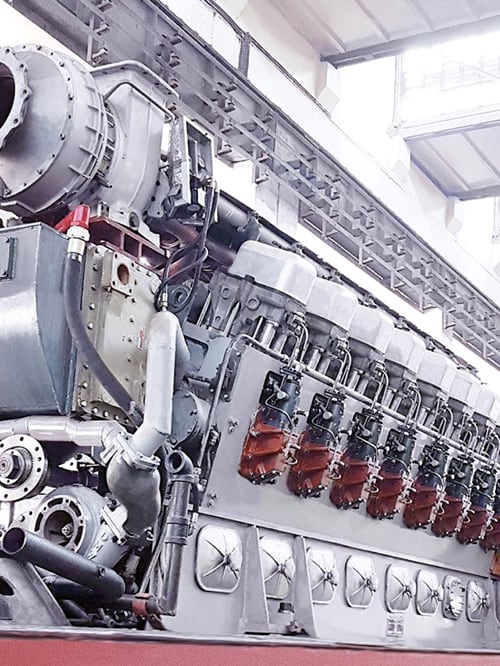

The answer lies partly in our legacy and partly in our mission. The legacy began nearly 120 years ago when Alfred Büchi first patented the turbocharger. Since 1924, when the first commercial design was delivered, that technology has helped shipping do more with less – boosting engine power, reducing fuel consumption and consequently, though it was barely considered at the time, cutting emissions.

So, Accelleron has been advancing emissions-reducing technology for more than a century, and when it became an independent stock-listed company in 2022, it made decarbonization its new North Star, investing in three levers that cut fuel consumption and emissions: turbocharging, digital optimization, and fuel injection.

Those levers have crucial roles to play at various stages of shipping’s decarbonization trajectory. The IMO has recognized three ‘horizons’ in its emissions reduction strategy; 2030, 2040 and 2050. The final goal of net zero by or around 2050 is supported by the indicative checkpoints ten and twenty years earlier. Each will see shipowners relying on a different recipe of solutions to meet the targets.

Up to 2030 – by which time IMO aims for at least a 20% reduction in overall greenhouse gas (GHG) emissions from international shipping, compared to 2008 levels – investing in efficiency will be key. In fact, an IMO-commissioned report from CE Delft found that energy-saving measures alone could meet and even exceed the IMO’s ‘striving for’ ambition of a 30% emissions reduction by 2030.

Driving efficiency and optimization

The study notes that operational measures such as slow steaming and vessel/voyage optimization could constitute roughly 50% of the reduction, technical retrofits about 25%, and zero or near-zero emission (ZNZ) the remaining 25%. Given CE Delft’s contention that applying all measures could add up to a 47% reduction, which implies that efficiency could deliver up to a 35% absolute emissions reduction, surpassing the higher boundary of IMO’s 2030 target.

Efficiency retrofits and operational measures can be implemented quickly, rolled into port stays, and paid back under today’s fuel and carbon prices. For Accelleron, that means turbocharger optimization – including tailoring for slow steaming with Engine Part Load Optimization (EPLO) and, for larger engines, enabling sequential turbocharging with FiTS2 – as well as digital vessel and voyage optimization via its LOREKA360° suite of solutions.

Accelleron already has operational evidence of the impact of these solutions. A car carrier on a fixed container schedule cut fuel use by 3% after engine derating paired with an optimized turbocharger. Installation during a routine port stay yielded a return on investment within months. Combined with a propeller upgrade, the package delivered 25% lower fuel consumption and emissions and a corresponding improvement in the vessel’s Carbon Intensity Indicator rating.

Meanwhile GESCO, India’s largest private shipowner, replaced manual engine performance checks with a continuous digital process – including automated diagnostics and advisory – via Tekomar XPERT, part of the LOREKA360° platform. The switch delivered annual savings equivalent to US$45,000 per vessel, and was rapidly expanded from two to 48 tankers and bulk carriers, with a cumulative savings of over $2.16 million annually.

Beyond horizon 2030

These solutions deliver efficiency and compliance today, and also prepare ships to use carbon-neutral fuels more efficiently and cost-effectively tomorrow.

But for the 2040 and 2050 horizons, the challenge is greater. By 2040, IMO aims for GHG reductions of at least 70%, striving for 80%. That depth of decarbonization cannot be reached by efficiency gains alone. Carbon-neutral fuels will be needed, meaning that vessels both new and old will need to install the engines capable of using them.

The ships are ready.

Accelleron’s next-generation turbochargers and dual-fuel injection systems are designed to handle all major fuels, including e-methanol, e-ammonia, e-methane, and hydrogen. They are engineered for adaptability, reducing retrofit complexity and cost so that ships can pivot quickly once new fuels arrive. A turbocharger can be switched during a normal port stay, making a vessel ready for e-fuels the moment supply reaches scale.

In 2024, nearly half of all tonnage ordered was alternative-fuel capable, according to DNV’s Alternative Fuels Insight (AFI) tool. In 2025, that momentum has accelerated, with the same tool showing a 78% increase in the first half of the year over the same period in 2024. That investment will need to increase to meet the 2040 target, and again in the final push towards 2050.

The signs are that, given the right regulatory and market signals, the industry will follow. After nearly two decades of innovation and investment in decarbonization technologies, ships and their engines are more efficient than ever, and ready to run on carbon-neutral fuels like e-methanol and e-ammonia.

The fuels are missing.

But a vital ingredient is missing: the fuel itself, produced at scale and at a competitive cost. This is the challenge the report addresses, proposing key steps that could help shipping find the 150 million tons in annual green hydrogen production that will be needed by 2050. All the investments that the industry – ports, shipowners, fuel suppliers and technology providers including Accelleron – have made will be for nothing unless that happens.

This is our stake, and our reason for launching the Accelerating to Net Zero initiative and Deadlock report series.

The path Accelleron has travelled over more than 100 years, with even greater intensity since independence in 2022, has been focused on efficiency and enabling the use of carbon-neutral fuels. Accelleron is a key link in the shipping stakeholder chain, and we share our customers’ commitment to see that those investments are not wasted. And, beyond the commercial sphere, Accelleron wants a sustainable future for our generation and future generations on this planet. With the technologies, but without the fuels, we are only halfway there.

➔ Download the full report here

And come join us on December 3 at the Green Maritime Forum of Pudong Shipping Week, where we will present a new 40-page report focused on carbon-neutral fuel deadlocks and opportunities in the shipbuilding region of the Asia Pacific.